Meet Multi-utility QR codes by OmniPay

Who would have thought that a QR code system invented by a Japanese automotive company, Denso Wave, to track vehicles during manufacturing would be a booming feature in the payment industry.

Table of Contents

What is a QR code?

QR codes or quick response codes are machine-readable codes that redirect the scanning device to specific URLs or pages.

Every mobile device today has an inbuilt QR code scanner, whether an Android device or an iOS making QR codes highly accessible.

These Rorschach-looking QR codes got widely accepted during the pandemic. People used these quick response codes to make contactless payments, share restaurant menus, etcetera.

Why use a QR code for payments?

QR payment is a pivotal contributor to a dramatic shift towards a cashless society.

According to Juniper research, “The global spend using QR code payments will reach over $3 trillion by 2025; rising from $2.4 trillion in 2022.”

A QR code comes in handy if you have one or more physical stores, host events, or have a payment page where you want to give users the ease to pay with their mobile phones.

With OmniPay, you can generate as many QR codes as you want and share them with your customers to easily make a payment using their phones. OmniPay QR codes support all major cards and wallets, enhancing the checkout experience.

Moreover, you can make specific QR codes and assign them to different store locations (store 1, store 2, et cetera.) or individual customers.

You can also stick QR codes onto the product packaging to help users scan and pay as soon as they receive the product.

The benefit of QR code payments

- Reconciliation is a breeze when you have specific QR codes for individual clients or locations.

- The in-store shopping experience can be improved using QR codes. Customers won’t have to pull out a card and enter the pin for payment every time they shop with you.

- After scanning the QR code, consumers can pay through e-wallets and cards using the phone. Moreover, it also eliminates the long in-store queues.

- Customers can make door-step delivery payments using QR codes. They can act as a vital alternative to cash on delivery if the customer is not holding cash.

- No information sharing. QR codes can process payments without sharing additional information between the payer and the payee.

- Multiple payment options. QR codes make it easier to provide customers with all payment modes possible. It also eliminates the cost and the need to rent a card machine for your store.

Benefits of generic QR codes:

- Redirect users/customers to any desired web page.

- Redirect users to menus, product brochures, websites/landing pages, et cetera

- Download apps on phones – redirection to app stores

- Redirect to email newsletter sign-up pages

- Redirect to booking a call (with apps like Calendly)

- Redirect to Feedback forms

- Redirect to Link to social channels, videos, tutorials, et cetera

- Sharing contacts (Vcards)

Using QR codes for different store locations

QR codes for different locations can help your business understand how much you earn from a specific store. By doing so, you can figure out which store is doing good and which one isn’t.

Reconciliation becomes more manageable using the reports from the Omnipay dashboard. You could use QR codes at stalls and outlets for specific products or use-cases at events.

Using QR codes for individual client

If your business has a customer that frequently shops from you or you are a B2B company, you can share a specific QR code customised for every client.

Whenever a business or an individual user wants to make a payment, they can rely on the QR code you customised for them. The system will assign a QR ID to such clients, and you can access their transaction history via the OmniPay dashboard.

The dashboard will help you reconcile payments easily, saving time and avoiding confusion regarding payments received from these clients.

Make a QR in a few clicks

Generating a new payment or generic QR code takes less than 38 seconds.

A few clicks and you’re good to go.

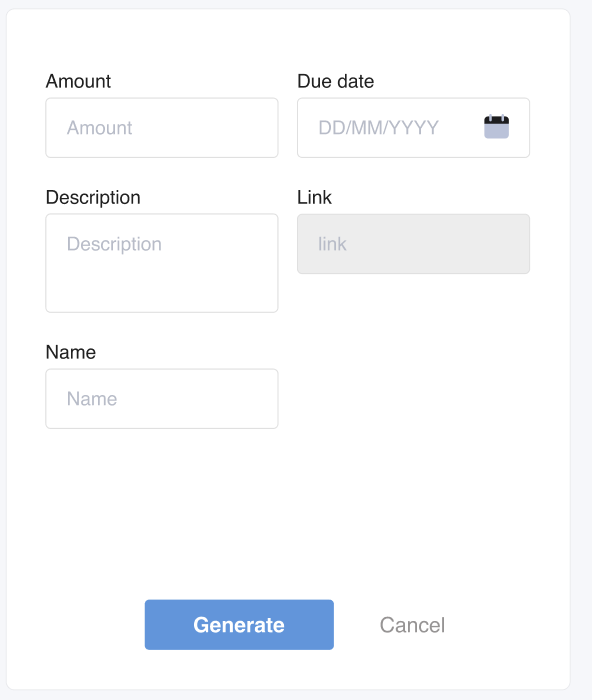

- Click the “Create QR” button

- Fill in the required details: Amount, Due Date/Expiry Date (date of closure of QR code) and the description

- The description shows on the QR code once it is made

- “QR Name” is a field to manage codes internally

- Click the Generate button

Share your QR code, download it or print it to start accepting payments or redirecting your users to web pages you want.

Track & refund payments anywhere

Use the OmniPay dashboard to track all received payments. Moreover, the OmniPay app allows you to track or refund transactions on the go using your phone.

Get notified real-time

You receive notifications whenever a user scans a QR code and pays you. You can receive notifications via email or through the OmniPay app. There’s no need to log into your dashboard to check if the transaction was successful or not.

Takeaways:

- You can use QR codes for both payments and online redirects.

- Easy to manage and track transactions using the dashboard

- No extra costs or maintenance (unlike a bulky card machine)

- Shareable using links, as PDFs or print and stick anywhere you want in your store.

- Reconciliation is straightforward by using the dashboard.

- QR codes for specific locations or clients are a powerful way to determine which store location makes the most for your business.

- Generate unlimited QR codes for no extra cost

Insightful , A must read.