Best 5 Small Business Payroll Software Small Businesses Can Leverage

Managing payroll is important for small businesses as it ensures that employees are paid accurately and on time. It helps to improve employee morale and motivation and reduce turnover. Additionally, it can help to prevent financial problems for the business, such as cash flow issues.

However, manually managing payroll can be a dreadful task as it is time-consuming and can be error-prone.

Businesses are required to withhold taxes from their employee’s paychecks, and if they do not do this correctly, they can be penalised. And, if businesses do not keep accurate records of their employees’ hours worked, they may have to pay overtime.

It is, therefore, beneficial for you to use payroll software. In this article, we look at a few of the best small business payroll software options available in the UK.

Table of Contents

Five best small business payroll software for small business

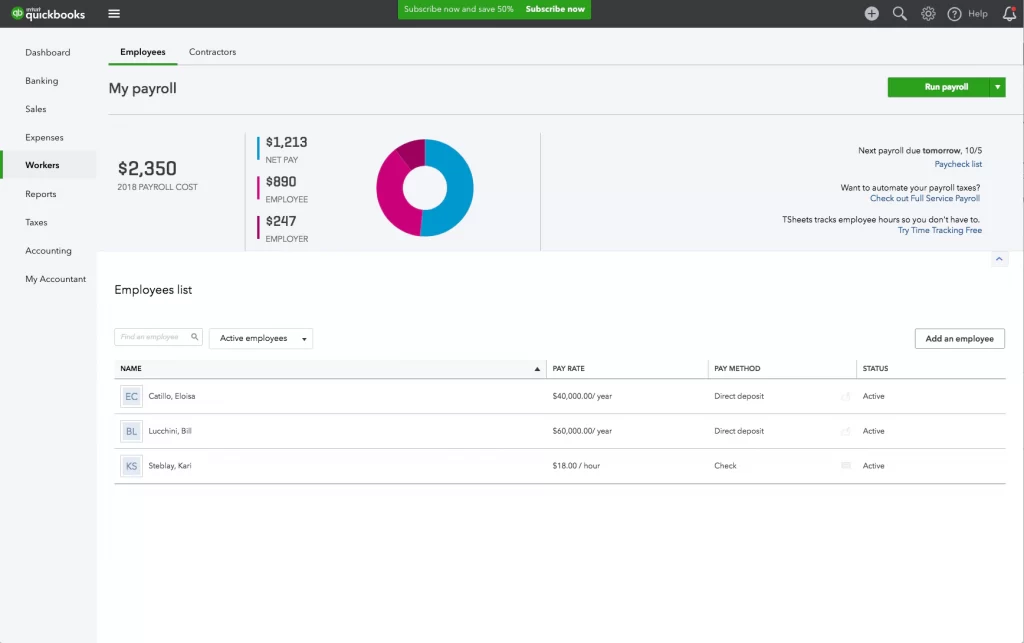

Intuit Payroll

PaySuite, a cloud-based payroll software provider in the UK, was acquired by Intuit QuickBooks in 2014.

This software tool allows you to submit your tax returns online, print payslips, enrol in CIS, access video support, and more. In addition, it submits real-time data to HMRC.

You can automate this feature to avoid missed filings. You’ll also receive an automatic update if you miss submitting the data, so you won’t have to worry about fines.

Intuit Payroll saves you time by allowing your employees to upload their data. In addition to phone and online chat, it provides a video call feature.

The features include:

- Full-service payroll

- Includes automated taxes and forms

- Auto Payroll

- 1099 E-File & Pay

- Expert product support

- Same-day direct deposit

- Expert review

- Track time on the go

- Health benefits for your team

- HR support centre

- Workers’ comp administration

- Track income and expenses

- Accept invoices and payments

- Maximise tax deductions

- Run general reports

- Capture and organise receipts

- Track miles

- Manage cash flow

- Track sales and sales tax

- Send estimates

- Manage 1099 contractors

- 1-5 users

- Manage and pay bills

- Track time

- Track inventory

- Track project profitability

There are three pricing plans:

- Payroll Core + QuickBooks Simple Start

- Payroll Core + QuickBooks Plus

- Payroll Premium + QuickBooks Plus

Check the pricing plan.

You can also try Intuit payroll free for 30 days.

Drawback

Some updates and the importing features can be frustrating (lost files, duplicate files, etcetera).

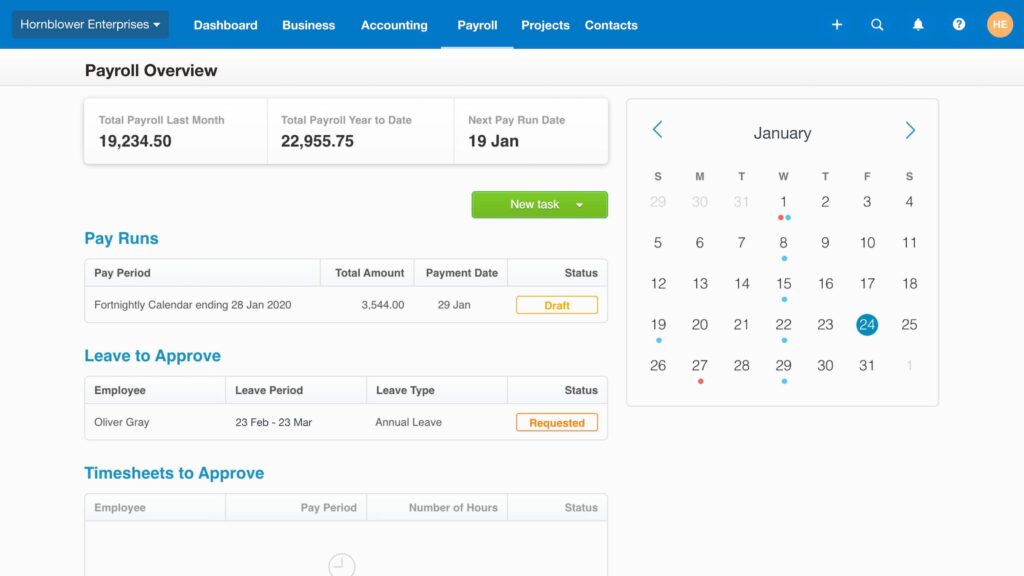

Xero

Xero has been in business since 2006 and has over 2 million customers with its SaaS accounting software.

According to government regulations, Xero allows you to input a pay run, make bulk payments, and email or print payslips for employees. With this platform, you can manage your payroll, finances, and pension all in one place.

With Xero payroll, you can track how many hours your staff has worked. By automating payroll calculations, you can run your company more efficiently. Furthermore, web access and the Xero Me mobile app provide employees with self-service alternatives, making their lives easier.

The features include:

- Pay bills

- VAT returns

- Claim expenses

- Bank connections

- Accept payments

- Track projects

- Payroll

- Bank reconciliation

- Manage Xero contacts

- Capture data

- Track your finances with accurate accounting reports

- Inventory tracking

- Send invoices

- Multi-currency accounting

- Purchase orders to create and send purchase orders online

- Send Quotes

- Analytics to check the cash flow

- Accounting dashboard to Keep an eye on your finances

- Manage fixed assets

Xero offers three basic plans: Starter, Standard, and Premium.

Drawback

Despite its simplicity, this platform has a steep learning curve.

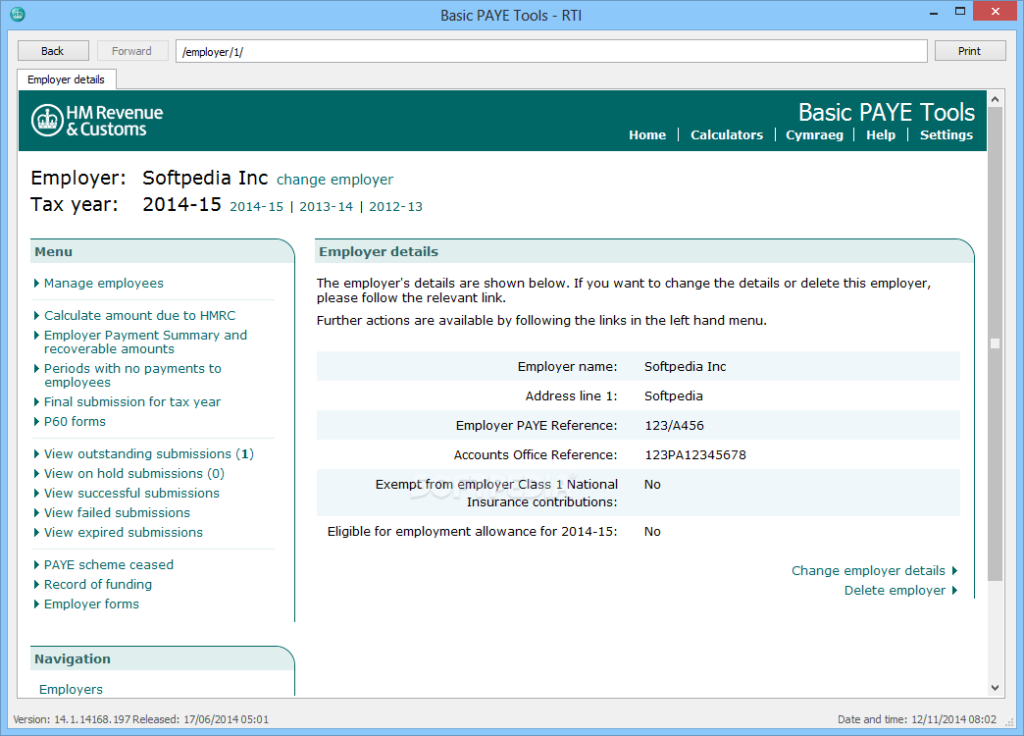

HMRC Basic PAYE Tools

HMRC Basic PAYE Tools is a free payroll software for UK organisations from HMRC. This software is developed by HMRC.

It is a convenient tool for keeping track of your PAYE information. The tools are very user-friendly and easy to use. It helps keep track of your PAYE information and helps you stay compliant with the law.

The software includes a full payment summary, employer payment summary, and National Insurance number verification.

The features include:

- Full Payment Summary (FPS) to let the organisation know the deductions like a tax from your employee’s pay.

- National Insurance Number Verification

- Employee Payment Summary (EPS)

- Earlier Year Update (EYU)

- Pricing

- Verdict — includes features such as National Insurance number verification, full payment summary, earlier year update, and an employer payment summary.

Here’s how you can download the software.

Drawback

Despite it being pocket friendly, there is no automatic enrolment feature in this software. If you do the process manually, your payroll could be susceptible to human error.

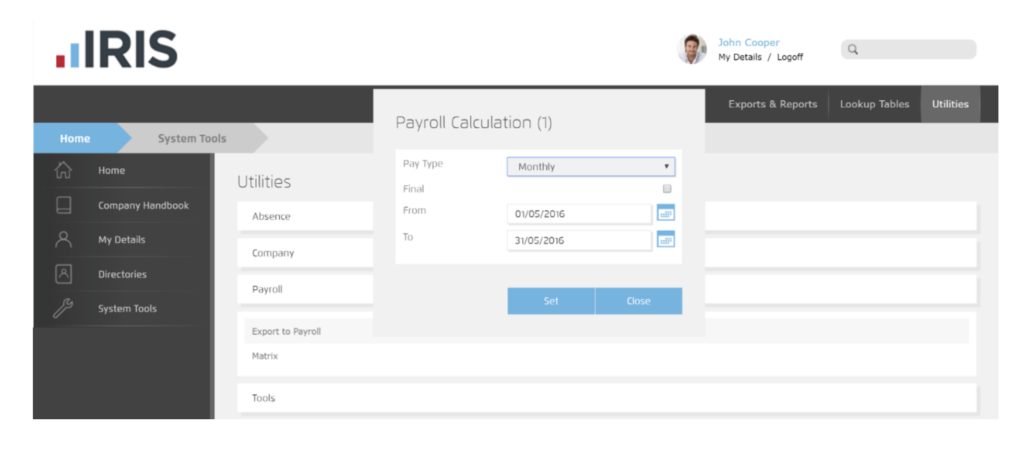

IRIS Payroll

With IRIS Payroll, small businesses can easily record employee absences and holidays and process payments. In addition to receiving employer payment records, managers can fill out various online forms, including P45s, using the software.

You can integrate IRIS Payroll software with HM Revenue and Customs (HMRC). It also updates the P32 at the end of the month.

Following RTI protocols, payroll administrators can keep track of payroll-related data and ensure compliance.

Features include:

- Job Retention Scheme (JRS)

- Flexible benefits

- Flexible payroll options

- IRIS Managed payroll

- IRIS Payroll Basics

- IRIS Payroll Business

- KashFlow payroll

- IRIS Payroll Professional

- IRIS Payrite

- IRIS Earnie IQ

- IRIS GP Accounts

- IRIS GP Payroll

- HMRC compliant

- Auto-enrolment

- Pay slip printing

- Absence holiday diary

Here’s the pricing plan.

| Plan | Pricing |

| IRIS Payroll Business (25 payslips) | £99.00 + VAT. |

| IRIS Payroll Business (25 payslips) + 1 Additional Company | £180.00 + VAT |

| IRIS Payroll Business (25 payslips) + 1 Additional User | £265.00 + VAT |

| IRIS Payroll Business (25 payslips) + 1 Additional Company + 1 Additional User | £346.00 + VAT |

Drawbacks

- This software is intended for UK-based businesses only, not for U.S. businesses.

- Timesheets and employee databases are not included in IRIS Payroll Business.

MoneySoft

The payroll manager of Moneysoft simplifies the process of making payments for CIS subcontractors, which includes automatic calculations and subcontractor verification, as well as 300 online HMRC submissions.

With Moneysoft payroll, you can stay on the right side of the law by submitting accurate payroll information to HMRC. Additionally, it is RTI compliant, so that you can submit all your documents on time.

Features include:

- RTI filing

- Employee Payslips

- Comprehensive reporting with email capability

- Automatic calculation of Statutory Sick (SSP)

- Maternity (SMP)

- Paternity (OSPP, ASPP) and Adoption (SAP) pay

- Shared Parental Pay

- Holidays

- End-of-the-year procedures

- Student Loans

- Attachments of Earnings

- Childcare Vouchers

- Data Backup facilities

- Auto Enrolment Pension reporting facilities

- Employers NIC Allowance

The pricing plan is categorised into — Payroll manager 20, Payroll manager 100, and Payroll manager 250.

Drawbacks

Moneysoft doesn’t have a Mac version.

Key takeaways

Payroll software has several advantages for every UK firm. You stay compliant, save time and money, reduce human mistakes, and pay your employees on time using the platforms.

You must choose the finest payroll solution for your organisation before purchasing any payroll solution. Our clever guide will assist you in selecting one that is appropriate for your organisation.